If you require advice in relation to any financial matter you should consult an appropriate professional. (NASDAQ: TYME) stock closed at 0.2479 per share at the end of the most recent trading day (a -1.74 change compared to the prior day closing price) with a volume of 442.17K shares and market capitalization of 43.62M.Is a component of indices and it is traded on NASDAQ exchange.

Nothing on this website constitutes, or is meant to constitute, advice of any kind.

Fintel makes no representations or warranties in relation to this website or the information and materials provided on this website. This website is provided “as is” without any representations or warranties, express or implied. See also AMC Short Interest, GME Short Interest, Scion Asset Management, Vanguard Group, Point72, Sabby,īaker Brothers, Citadel Advisors, Himalaya Capital, Baillie Gifford, See our Privacy Policy and Terms and Conditions. Information includes fund holdings, fund sentiment, financial data, and regulatory filings (including SEC, LSE, ASX, and SGX). Meanwhile, the Dow Jones Industrial Slipped by -0.54%.Fintel® provides advanced research tools for data-driven investorsįintel currently tracks over 9500 funds and over 63,000 securities traded worldwide. Other than that, the overall performance of the S&P 500 during the last trading session shows that it lost -0.75%. The stock, however, is off -1.57% from where it was a year ago. On the other hand, the price of Dare Bioscience Inc. In comparison, Applied Genetic Technologies Corporation (AGTC) has moved lower at -6.91% on the day and was down -78.61% over the past 12 months. TYME showed an intraday change of 3.24% in last session, and over the past year, it shrunk by -84.17%%. (TYME) with its peers suggests the former has fared considerably weaker in the market. (TYME)’s beta value is 1.11, and its average true range (ATR) is 0.03.Ī comparison of Tyme Technologies Inc. The Relative Strength Index (RSI, 14) currently indicates a reading of 44.79, while the 7-day volatility ratio is showing 9.57% which for the 30-day chart, stands at 10.81%. The stock’s technical analysis shows that the PEG ratio is about 0, with the price of TYME currently trading nearly -4.87% and -16.54% away from the simple moving averages for 20 and 50 days respectively. However, medium term indicators have put the stock in the category of 100% Sell while long term indicators on average have been pointing out that it is a 100% Sell. We see that TYME’s technical picture suggests that short-term indicators denote the stock is a 100% Sell on average. Revisions could be a useful indicator to get insight on short-term price movement so for the company, there were no upward and no downward review(s) in last seven days.

currently standing at about $41.28 million, investors are eagerly awaiting this quarter’s results, scheduled for – Aug 12, 2022.Īnalysts have estimated the company’s revenue for the quarter at $1.3 million, with a low estimate of $1.3 million and a high estimate of $1.3 million. With the market capitalization of Tyme Technologies Inc.

#Tyme technologies inc full#

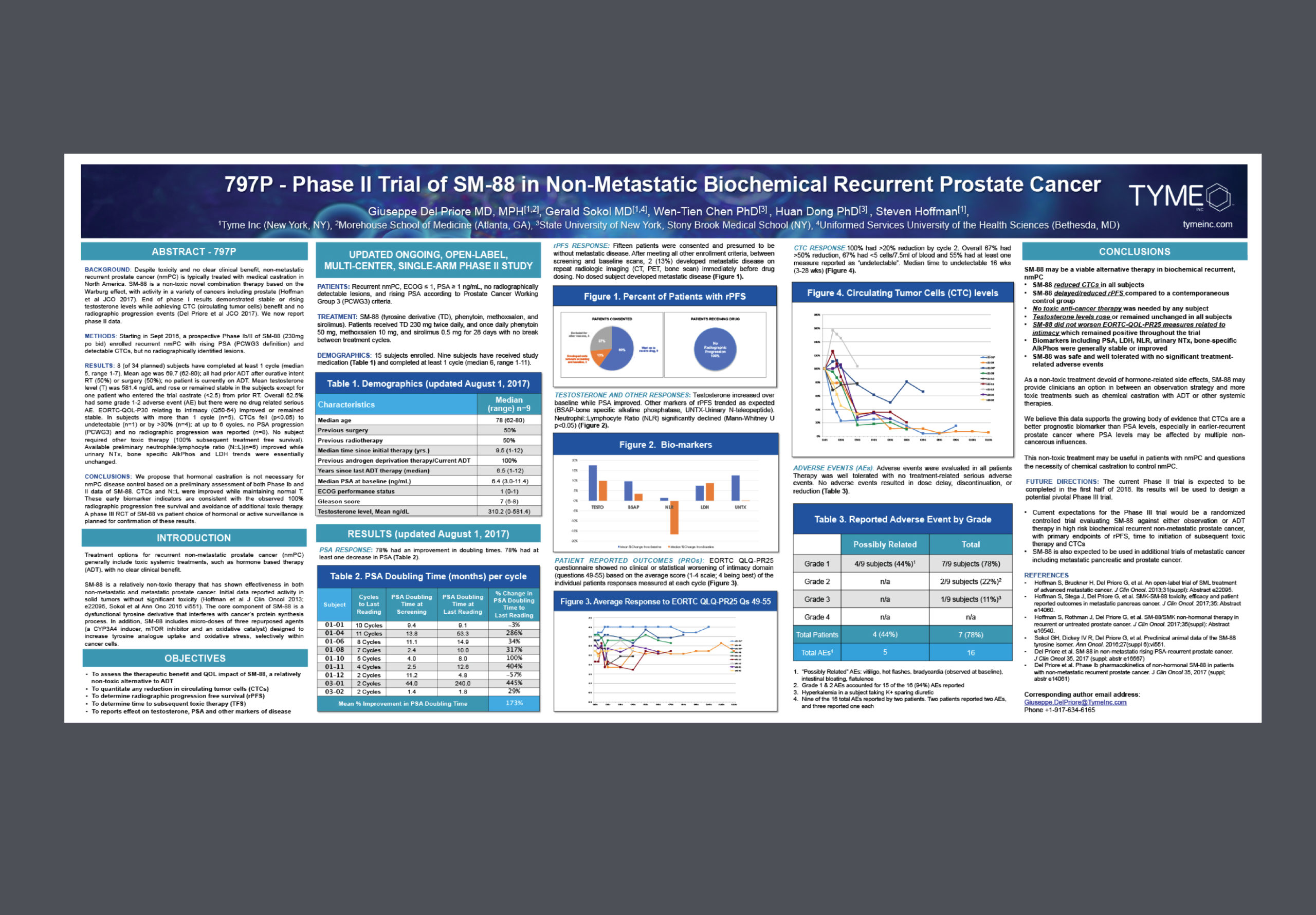

We've set up an alert service to help smart investors take full advantage of the small cap stocks primed for big returns.Ĭlick here for full details and to join for free. TYME is an emerging biotechnology company developing cancer metabolism-based therapies (CMBTs TM) that are intended to be effective across a broad range of solid tumors and hematologic cancers, while also maintaining patients’ quality of life through relatively low toxicity profiles. For stock market investors that means buying up cheap small cap stocks like these with huge upside potential. He buys up valuable assets when they are very cheap. The world's greatest investor - Warren Buffett - has a simple formula for making big money in the markets.

0 kommentar(er)

0 kommentar(er)